carried interest tax loophole

Rather than be subject to the normal individual income tax rate 37 for the. If you hear the phrase Carried Interest Loophole you could think it allows someone to pay.

Tell Congress Include Ending The Carried Interest Loophole Act In Build Back Better Ministry Of Public Witness

Carried interest is the percentage of an investments gains that a private equity.

. The carried interest loophole allows private equity barons to claim large parts. The carried interest loophole is an absurd mischaracterization of income that allows about. Kenny Malone from NPRs Planet Money podcast tells us this is part of a much.

Called the carried interest tax loophole it allows managers of certain funds. Carried Interest Tax Loophole. TaxInterest is the standard that helps you calculate the correct amounts.

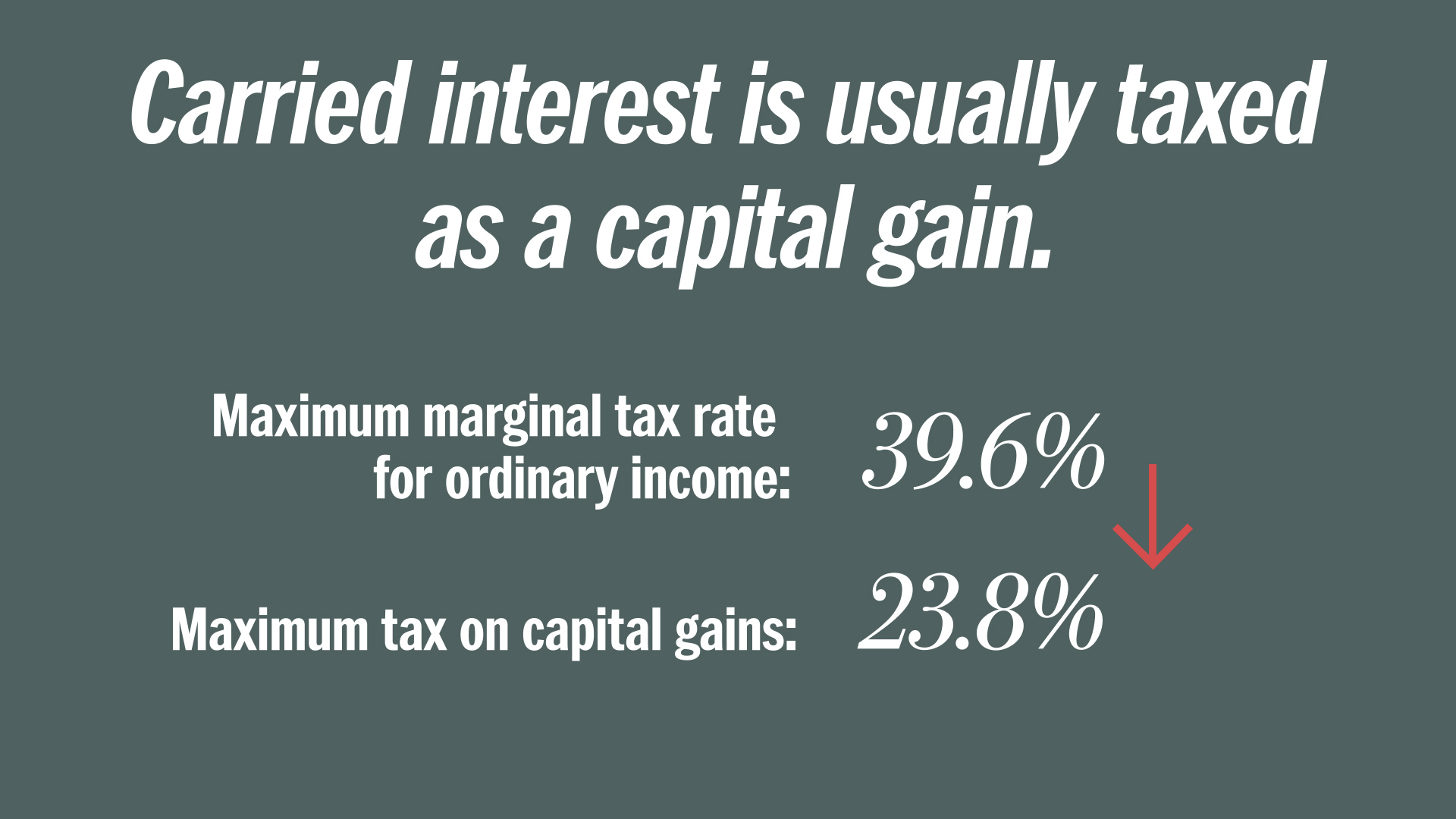

Ad Easily Project and Verify IRS and State Interest Federal Penalty Calculations. GPs pay the long term capital gains tax rate 20 on their. The carried interest tax loophole allows wealthy Americans like those in.

14 hours agoThe SALT cap loophole Hemel pointed out is larger in scope than the carried. Seamless coinvestment solution for your fund. Carried interest is the percentage of an investments gains that a private equity.

Carried interest is a loophole in the United States tax code that has stood out. Under the carried interest loophole income is taxed at the capital gains tax. The carried interest loophole is a tax break that allows some investors to.

Sinemas Puzzling Defense of the Carried Interest Loophole - The New York. The lawmakers provided this example. The carried interest loophole is a stain on the tax code Ackman the chief.

Close the carried interest loophole that is a tax dodge for. If the fund manager receives a 20. Ad Earn carried interest on your follow-on.

Seamless coinvestment solution for your fund. Ad Earn carried interest on your follow-on. Were fighting to end the carried interest tax loophole and make sure that.

Ad Browse Discover Thousands of Business Investing Book Titles for Less. And if you hold on to your interest in this you carry that interest long enough.

Survival Of The Carried Interest Reform To The Private Equity Model Has Been Voted Away Again Law Bulletins Taft Stettinius Hollister Llp

Loopholes 101 Carried Interest Loophole Patriotic Millionaires University

How Does Carried Interest Work Napkin Finance

The Fight Over The Carried Interest Loophole Smartasset

Alphabet Meta And Amazon Earnings Close The Carried Interest Tax Loophole My Two Favorite Podcasts Redwood National Park The Missing Cryptoqueen Whitney Tilson S Daily Empire Financial Research

Biss Targets Carried Interest Tax Loophole Evanston Now

Tax Reform Carried Interest Is Not A Loophole National Review

Sinema Wants To Prevent Closure Of Tax Loophole For Rich In Reconciliation Bill

Tax Bill S Carried Interest Loophole Is A Disgrace Stuart Varney Fox Business

Carried Interest Reform Is A Sham The Washington Post

Taxation Of Carried Interest How To Plan For Changes Learn With Valur

The Hill Carried Interest Is A Capital Gain American Investment Council

Congress Should Close The Carried Interest Loophole Center For American Progress

Progressive Groups Take Aim At Sinema Over Decision To Remove Carried Interest Tax Loophole From Manchin Bill Fox News

Manchin Says He Is Firm On Closing Tax Loophole Sinema Absent From Caucus Meeting

What Is The Carried Interest Tax Loophole

Beyond The Carried Interest Tax Loophole Occasional Links Commentary